Our History

Our funds have navigated a variety of market environments for a wide range of investors.

Building on a foundation established in 1975, RMB Funds offers distinctive mutual funds that have navigated various market environments for a broad array of investors by combining decades of experience with a specialized focus, intensive fundamental research, and an opportunistic approach.

Our Team

Our Portfolio Management Team averages 25+ years of investment experience.

For more details on our team, please click here.

Life Cycle Approach

What Makes Us Different

- Economic Return Framework – Applying our team’s 20+ year depth of accounting and valuation expertise to measure corporate performance

- Life Cycle Approach – Innovative approach to investing

- Intellectual Independence – Tied to a proprietary value creation framework

Our Philosophy

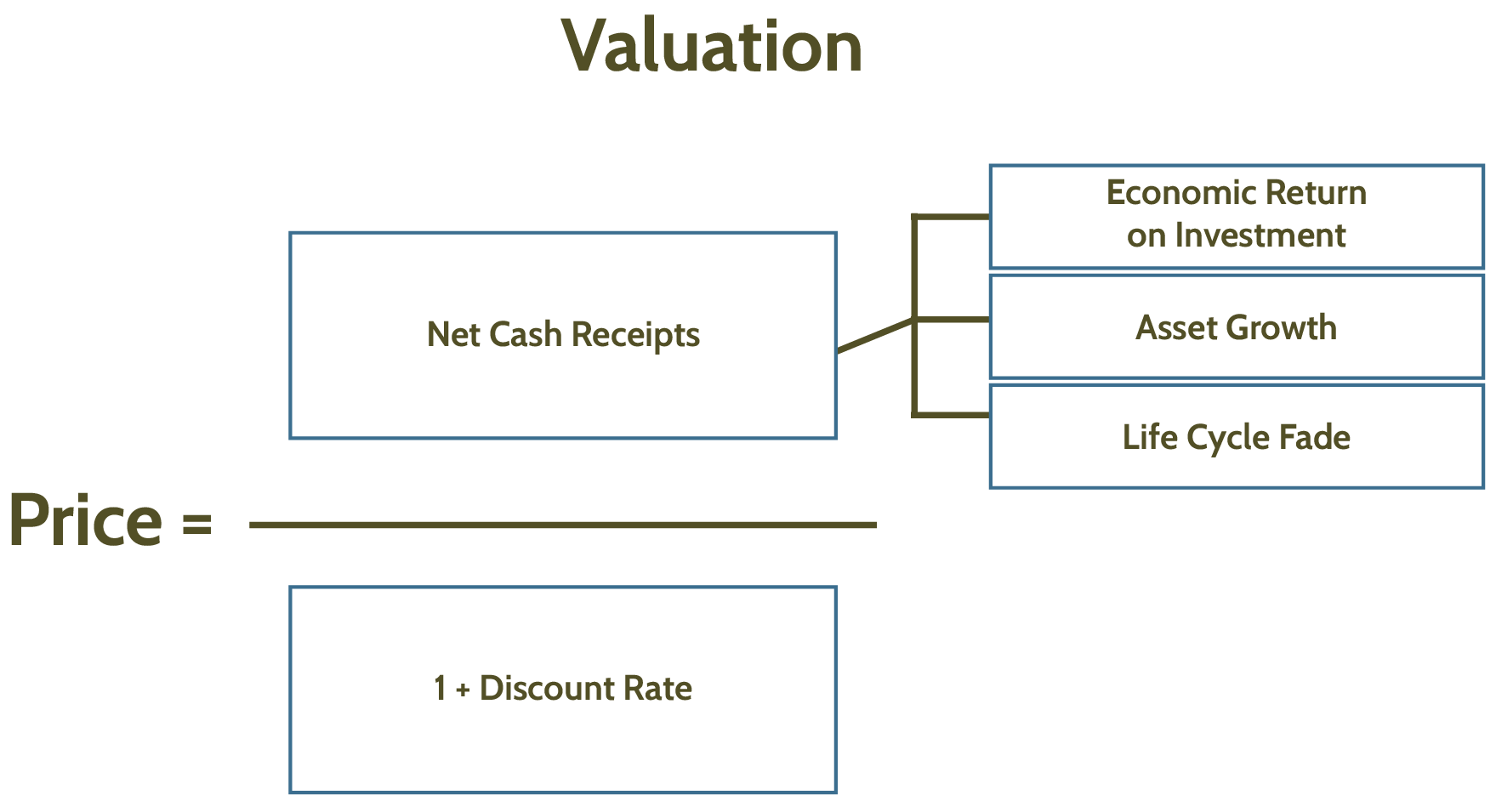

We strive to identify companies that we believe are the best allocators of shareholder capital, invest in those companies when we believe they offer an attractive risk/reward profile, and manage portfolio risk by isolating stock selection as the main driver of excess return.

Identify Well-Managed Companies

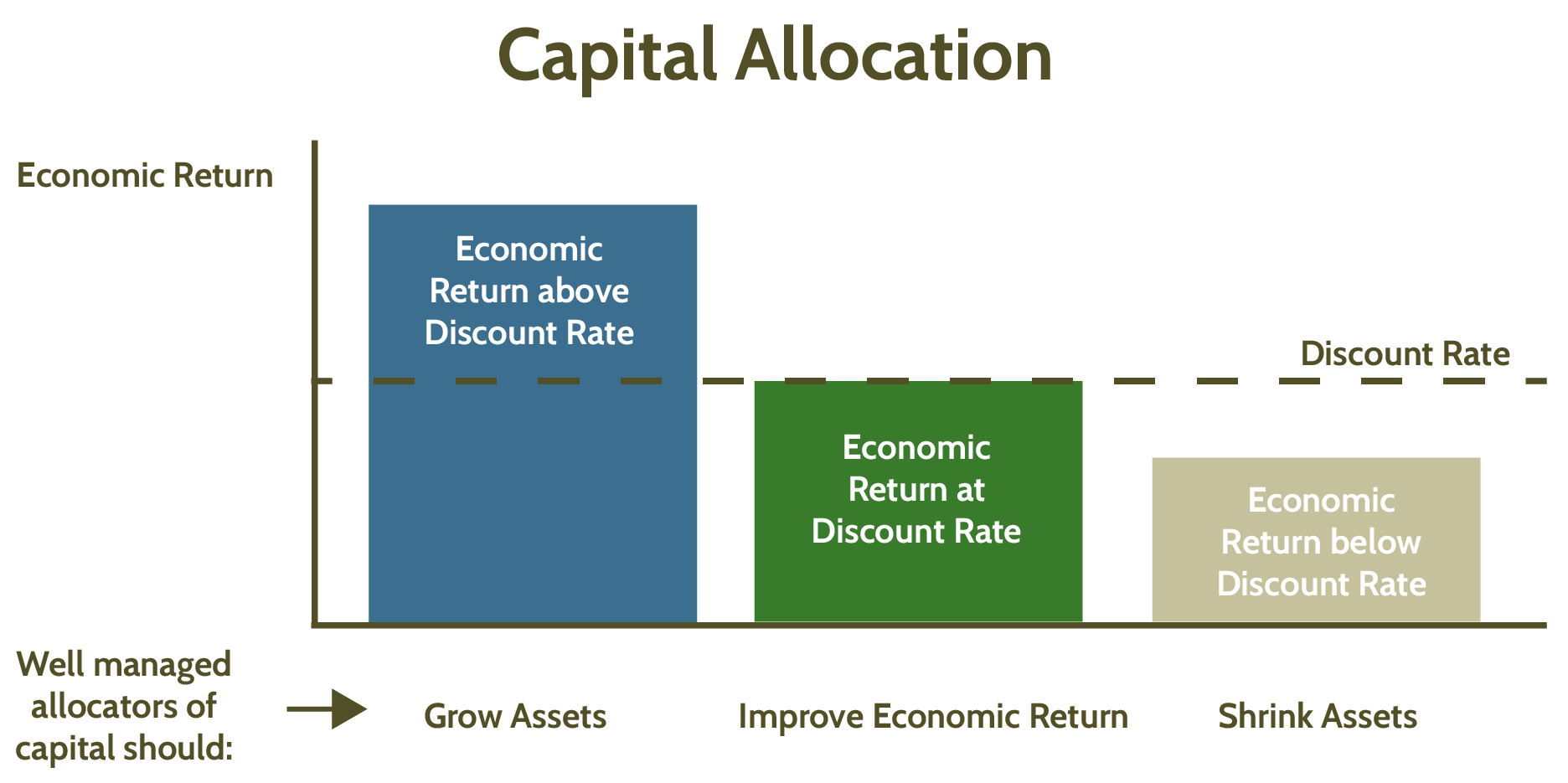

We believe well-managed businesses are those that:

- Grow assets when their economic return on capital is above the cost of capital

- Shrink assets when economic return is below the cost of capital

- Seek to improve economic return when it is approximately equal to the cost of capital

Differentiated Process

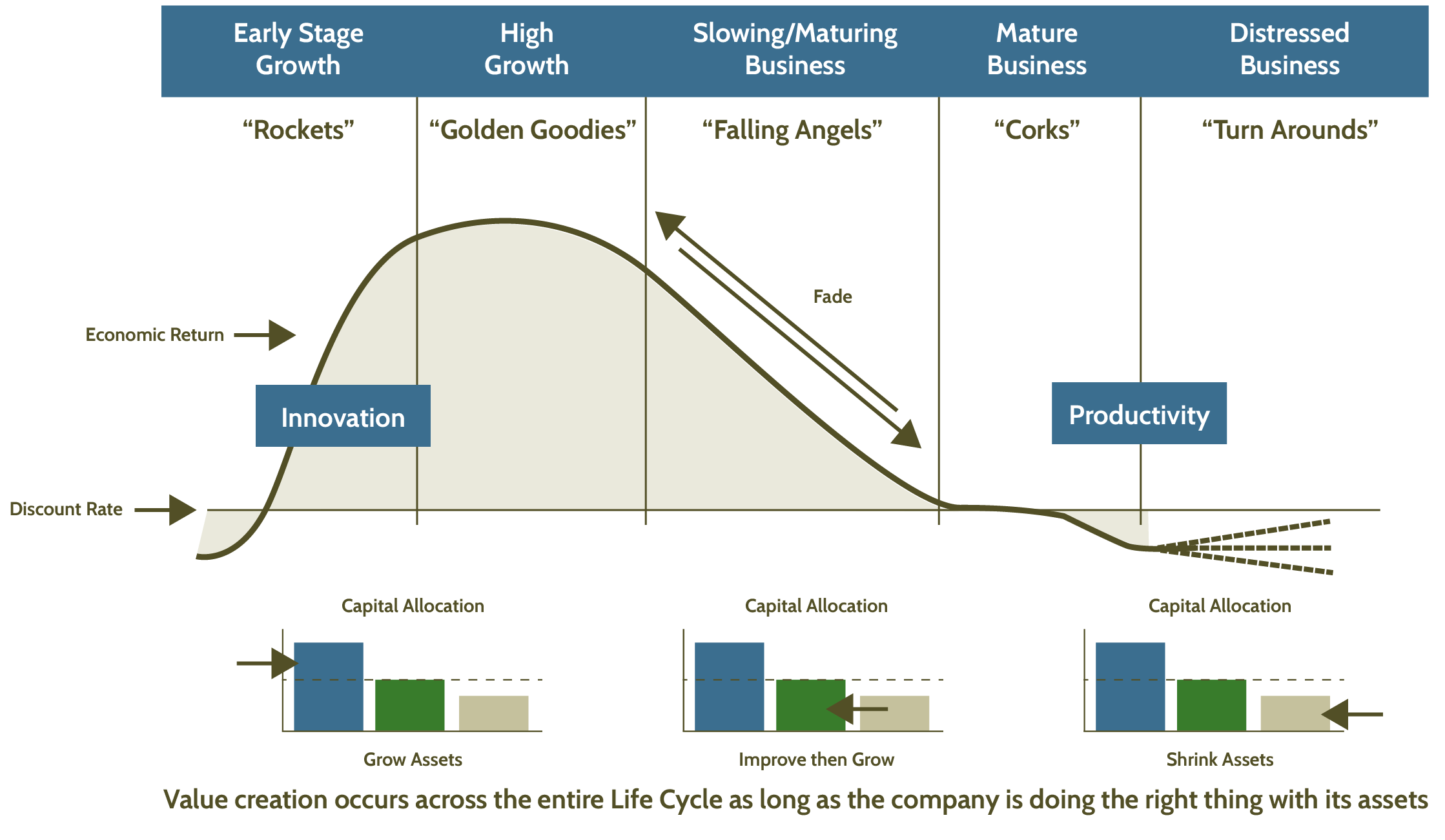

We believe in assessing companies through the Life Cycle Framework.

The Life Cycle Framework

- Recognizes that all companies go through development, growth, maturity, and decline and some “re-birth”

- Helps uncover the right analytical questions and focus attention on the key issues likely to determine future excess return

- A company’s position on the Life Cycle depends on the level and change of its economic return and its reinvestment rate

- Value creation is driven by “innovation” for companies on the left side of the life cycle and “productivity” for companies on the right

Rockets/Accelerating: These are hyper growth, early stage companies which consume a lot of capital as they try to execute their business model. Typically, they are innovative with new products, new services or new business processes that may threaten the status quo of existing larger companies. Upside potential may be huge, but so is downside risk. Volatility is high, and results are often binary.

Golden Goodies/Compounding: These are Rockets/Accelerating that have survived and proven that they have viable long-term business models. They have historically tended to grow faster than the overall market and need to beat the fade in returns by continuing to fend off competitive threats. These have a history of being classic asset compounders and will continue to create wealth for as long as they can beat that fade.

Falling Angels/Slowing/Maturing: These are Golden Goodies/Compounding whose growth rates have slowed because they have become so large or their economic returns have been falling because of competitive threats or an inability to find reinvestment opportunities at current high rates of return.

Corks/Mature: These are mature companies where the economic returns approximate the cost of capital. Asset growth does not add or destroy value, so improving the level of economic return is critical to their success.

Turn Arounds: These distressed companies are the victims of overcapacity, weak competitive position, or poor capital allocation. In order to be successful, they must divest the lower return segments of their overall business.

The opinions and analyses expressed in this letter are based on Curi Capital, LLC’s (“Curi Capital”) research and professional experience and are expressed as of the date of our mailing of this letter. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future performance, nor is it intended to speak to any future time periods. Curi Capital makes no warranty or representation, express or implied, nor does Curi Capital accept any liability, with respect to the information and data set forth herein, and Curi Capital specifically disclaims any duty to update any of the information and data contained in this letter. The information and data in this letter do not constitute legal, tax, accounting, investment, or other professional advice. The information provided in this letter should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any securities transaction or holding discussed was or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.